Making your kids financially literate

The most wonderful and joyful moment in any parent’s life is welcoming a new born baby in the family. Along with joy this brings additional responsibility.

Just as it is important to inculcate good values and virtues, it is equally important to focus on financial literacy for your kids. Making them understand about money matters and finance can help them build strong investment base right from early stage of their life, allowing them to reap benefits later.

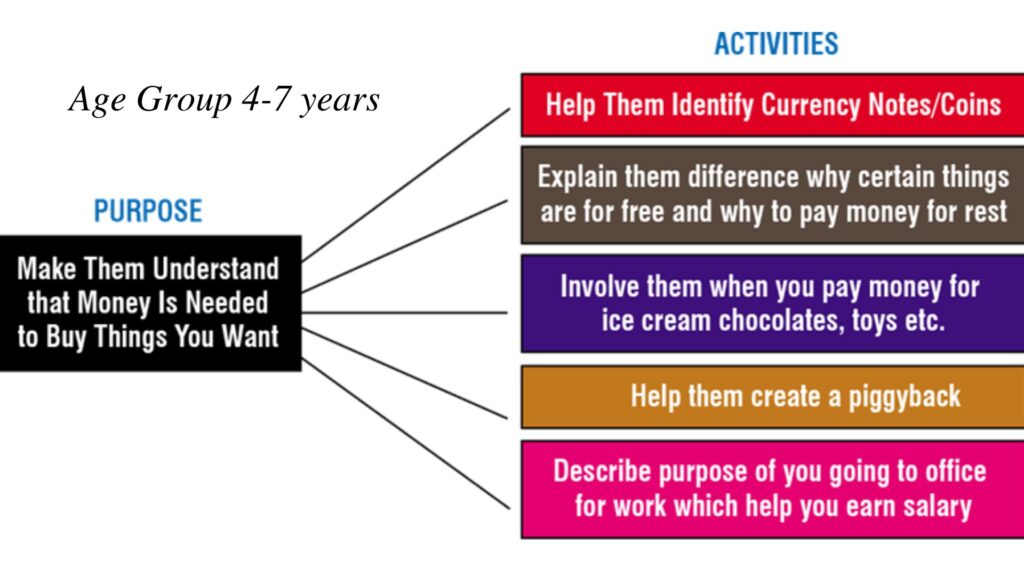

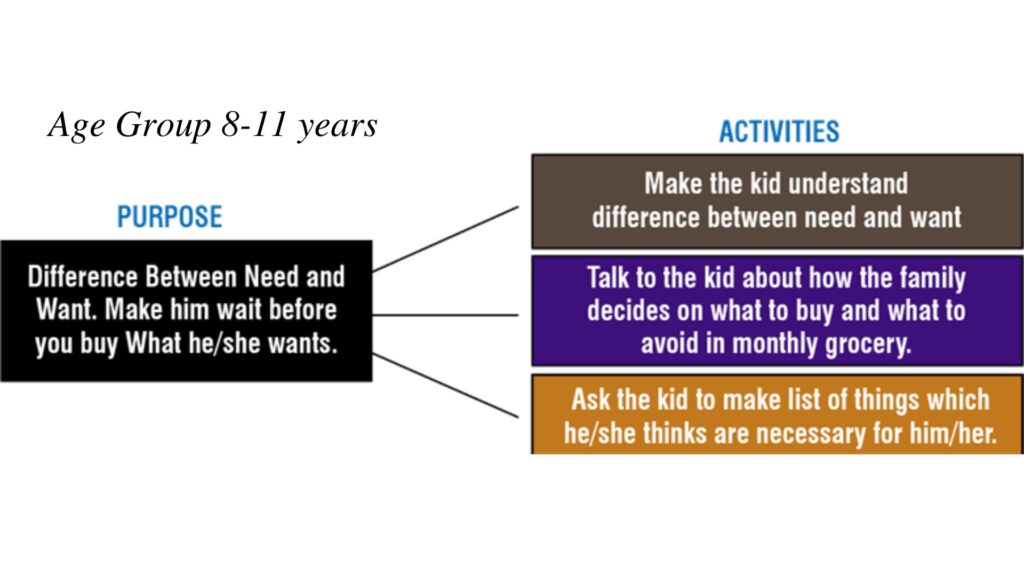

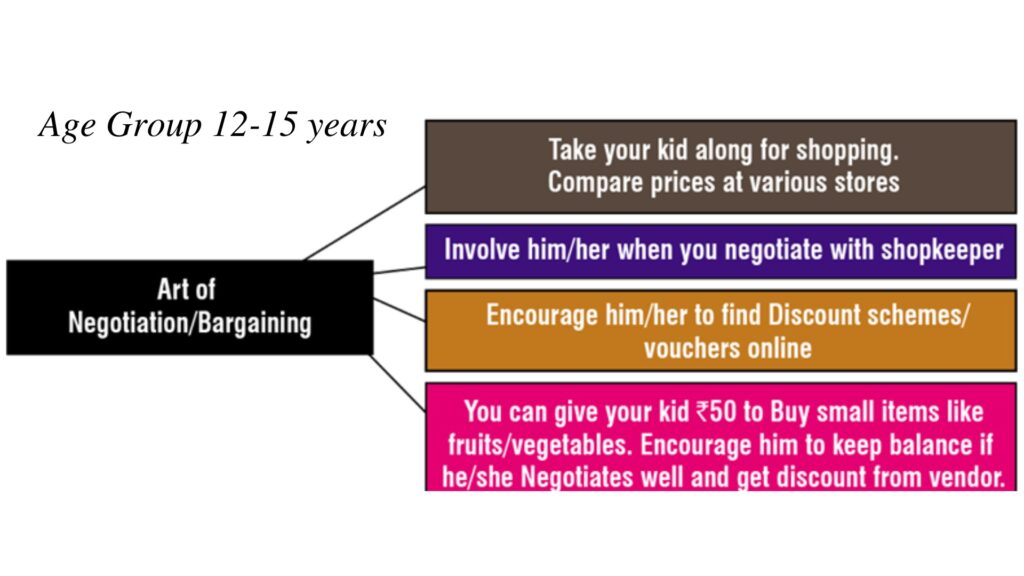

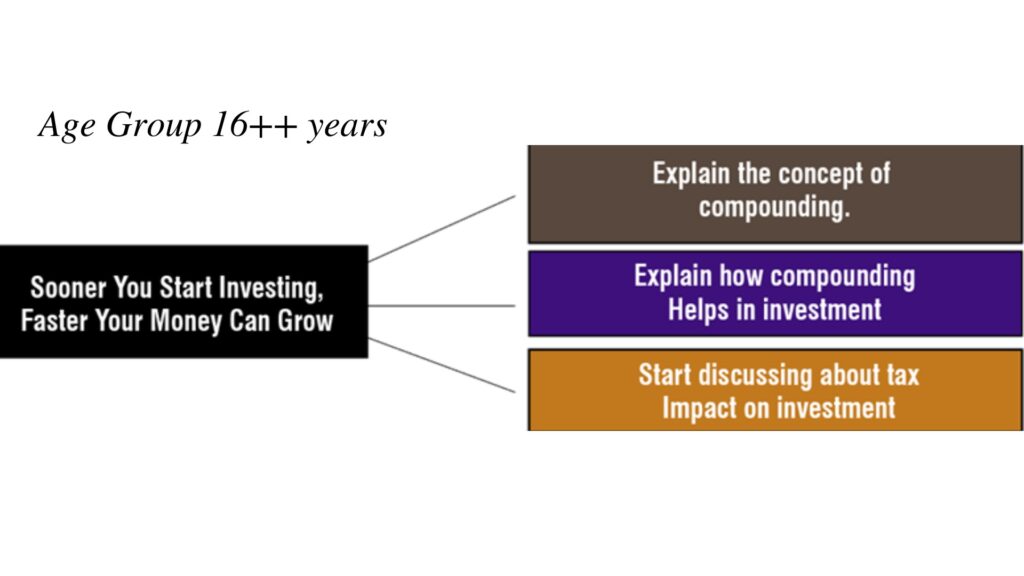

Different kids at different age groups need to trained in different way.

For adult kids — Just as knowledge of compounding is important, knowledge of inflation is unavoidable. How inflation eats into the value of money and how it affects both investment as well as day to day life. Make the kid understand about why it is important for any investment to beat inflation to grow your money.

Make your kid understand about not spending through credit card on something which you cannot pay in cash later. One falls in debt trap if he/she spends beyond ones paying capacity. Discuss about high penalty and interest rates charged by credit card companies on late payment and how one’s credit score gets negatively affected.

Also discuss danger of providing personal data online and not sharing confidential information like passwords and fraud e mails in name of lottery winning, free holiday trips etc. Not to respond to these types of mails by providing account number / ATM Card, Credit Card number or PIN.

This is the time when kids start preparing for their higher studies. Once the kid decides on type of course to pursue, you can ask the kid to calculate total cost involved for the course across different colleges which includes not only college fees but also study material cost, tuition fees, hostel expense if college is in different city as well as commutation cost. Kids can calculate the entire cost of the course across various colleges, compare and decide on his/her own. Also discuss about concept of education loan and pros and cons of taking education loan.

Educating your kid on financial matters is an ongoing process. Unfortunately, our education system does not focus on practical aspect of finance world at primary or higher education level. The onus is on parents to educate their kids about financial matters so that they enter the professional world fully prepared.

PS– Age groups are just indicative in nature and depending upon child one may advance the process.

Source—various articles on personal finance.